Car Accident Insurance Claims

Once the dust has settled, you will need to inform your insurer of the accident and, if your car is sufficiently damaged, begin the process of making a claim...

Contact your insurer

Make sure you tell your insurer about the car accident as soon as you can. Failure to do so within the time period set out in your policy may invalidate your cover, leaving you with a big bill to pay.

How long long you have to to file an insurance claim after a car accident varies. Make sure you check the wording of your car insurance policy carefully as these time periods can be anything from two days to two weeks after the accident.

You should always inform your car insurance company about an accident, even if you don't want to make a claim.

Information on other drivers

If the car accident involved another vehicle you will need to provide your insurance company with details of the other driver.

Try to provide:

- Their name.

- Their address and contact details.

- Their vehicle registration number.

- Their car insurance company details.

Details of the accident

You will also need to give your insurance company as much information about the accident as possible. Use sketches to help explain what happened and include any pictures you took at the scene of the accident.

Also provide the contact details of any witnesses who have agreed to support your claim.

What happens next?

If you want to continue with your claim, your insurance company will let you know what you need to do. If other people were involved in the accident, your insurance company will contact their insurance companies and resolve the claims.

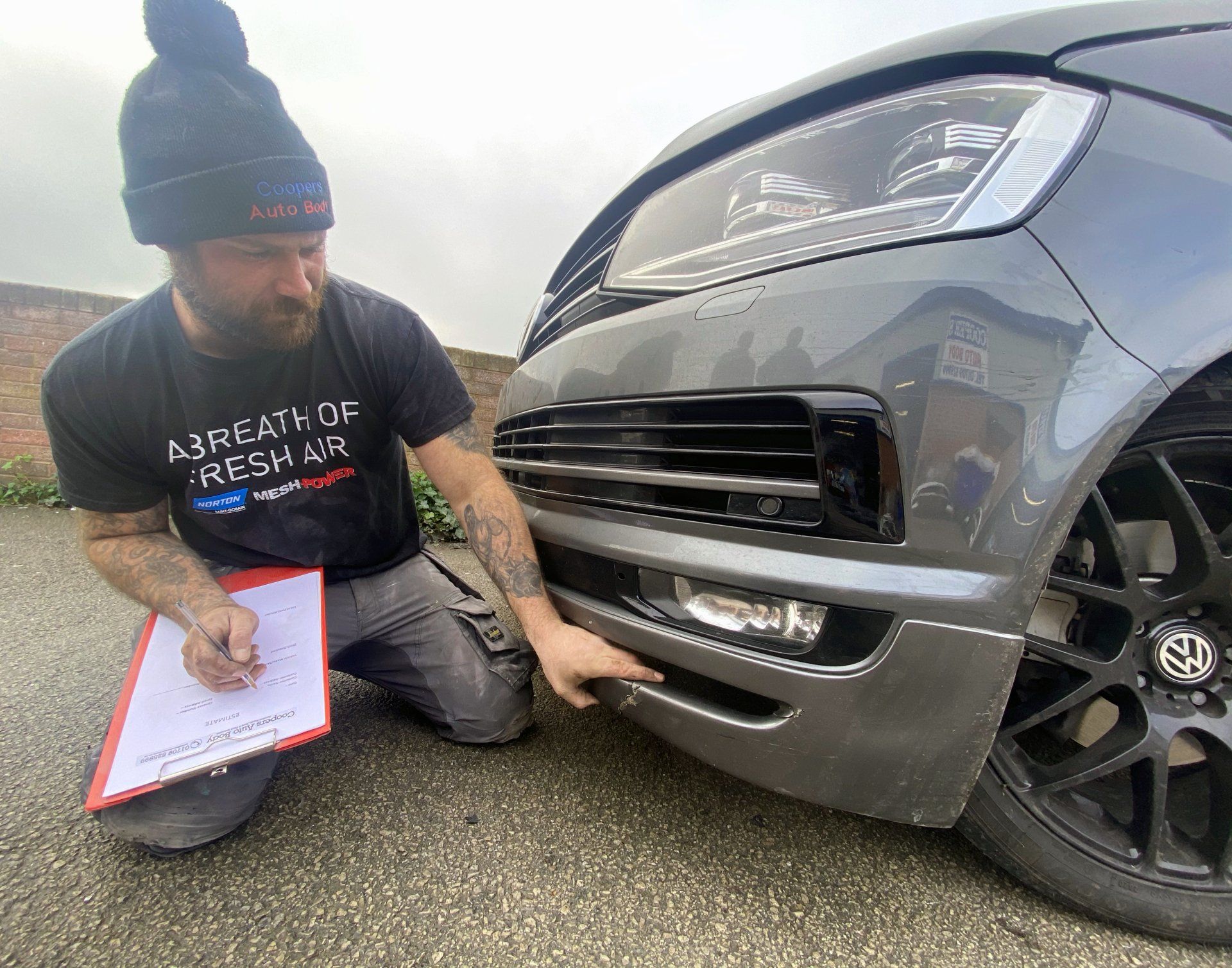

Finally, choose Coopers Auto Body

You have a legal right to choose who repairs your car, even if you're making a car insurance claim for it. According to legislation known as the Block Exemption Regulation, your insurer can't force you to use their repairers and they'll still pay out for the repairs if your claim's accepted.